Content

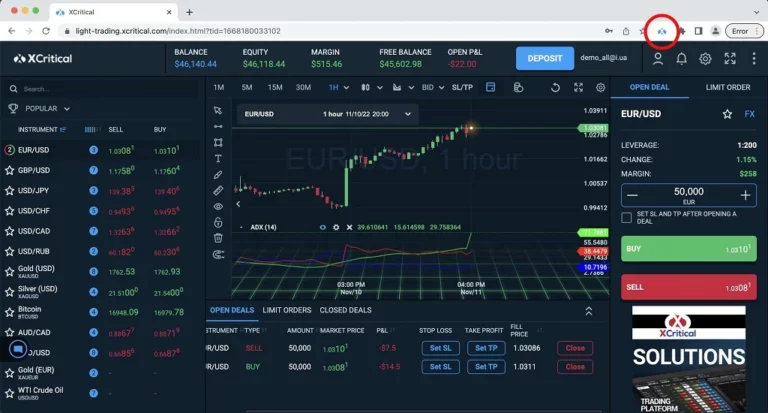

They’re looking at it from, I guess, at one level up, at infrastructure level as well. I think for payments use cases, it does feel like all roads are leading to Solana at the moment. I’m sure, for a fact, just like we’re a multi-stablecoin platform, we will live in a multi chain world. I would argue Solana is probably leading the payments race today, with a whole host of other awesome things that they’re building there. But I just think you need that level of performance in a payment system to actually tap into the longterm benefits of a new payments infrastructure. A global payments platform set at the intersection of realtime fiat payments, as well as blockchain payments, https://www.xcritical.com/ and really bringing those three payments use cases to life.

Cross border payment revenues to reach $280 billion by 2030

But fiat payment systems struggle across borders, slowing down economic activity. Standard settlement cycles are T+2 – and sometimes longer, eg to emerging markets, if low-value transactions are settled in bulk, or where high value payments exceed transaction caps. While in transit that capital is unavailable for liquidity, and for fintechs this creates a barrier to growth and the necessity to fill the gap with corporate capital. One of the most significant advantages of stablecoins for businesses in emerging markets is their ability to facilitate international trade with lower costs and fewer complexities. Traditionally, businesses in emerging economies face substantial barriers when engaging in cross-border trade, including high fees for foreign exchange and banking services, long transaction times, and currency volatility. These stablecoin payment system obstacles can deter businesses from participating fully in the global market and limit their growth potential.

East Meets West: key learnings from the rapid rise of mobile payments in mainland China

Whereas stablecoins are digital assets issued by private companies — such as stablecoin issuers like Ripple mentioned above, among others — CBDCs are issued by central banks. Dollar-denominated stablecoins are increasingly being used as a store of value and a hedge against inflation and weak currencies in emerging markets. There’s over $100 billion in combined market capitalization of dollar stablecoin adoption in Sub-Saharan Africa to safeguard against Cryptocurrency exchange the devaluing of local money.

Fiat-collateralized stablecoins

Access to US dollars and other global currencies is facilitated by a network of correspondent banks and payment companies. This can lead to long chains of friction reducing transaction efficiency and increasing cost. At points along this chain, third party risks, burdensome regulation or bad actors can constrain access altogether.

- Stablecoins are vital for the cryptocurrency ecosystem because they offer stability and value that other cryptocurrencies lack.

- Payments can pass through multiple intermediary banks before reaching the final destination, and tracking the status of the payment is difficult.

- Security and transparency are paramount when it comes to handling cross-border transactions.

- Note, however, that we do indicate in all cases if a data vendor or other party has a right to review a post.

- This volatility creates uncertainty and makes it difficult for businesses to plan for the future or for individuals to preserve their wealth.

Spotlight on Stablecoins for Payroll

Stablecoins come in several varieties, each employing different mechanisms to maintain price stability. These types include fiat-collateralized, crypto-collateralized, algorithmic and commodity-backed stablecoins. Each type has unique characteristics, advantages and potential risks. We’re helping fintechs like Freemarket launch stablecoin wallets, so their customers can see a stablecoin balance alongside a fiat one, and move money instantly.

While stablecoins offer numerous advantages in the realm of cross-border payments—such as lower fees, faster settlements, and greater transparency—these benefits come with a growing set of regulatory challenges. As stablecoin adoption increases globally, governments and regulatory bodies are grappling with how to ensure that these digital currencies are used safely, securely, and in compliance with existing financial regulations. The regulatory landscape surrounding stablecoins is still evolving, and different jurisdictions are taking varied approaches to addressing the risks and opportunities posed by these digital assets.

Remittance platforms are also adopting USDC for transfers to Latin America. A growing number of fintech platforms are integrating USDC into their payment systems to allow users to send remittances directly to their families. Because USDC is pegged to the US dollar, recipients receive more predictable and stable values compared to traditional remittance methods, which are subject to exchange rate fluctuations and hidden fees. In addition to transparency, blockchain networks provide a high level of security.

If consumers and businesses find stablecoins easier and cheaper to use for international payments, they may bypass traditional banking systems altogether, reducing banks’ revenue from foreign exchange and remittance fees. By bypassing traditional banking systems, stablecoins provide a low-cost alternative for cross-border payments, helping to reduce poverty and improve financial inclusion. This trend is poised to transform cross-border payments in many key areas, potentially lowering barriers to dollarization, making the storage of foreign currency easier, and facilitating transactions in foreign currency. This could pose risks to the stability of weak currencies and their policy frameworks, highlighting the significant economic implications of stablecoin adoption. In conclusion, stablecoins present a compelling alternative to traditional payment methods for cross-border transactions.

It brings together the best of both systems to unlock trillions of dollars of working capital and power economic growth. It recognises the efficiencies of stablecoins, and the dominance and network effect of fiat currencies like dollars. Second, customers can exchange these deposits for goods or services using well-functioning existing payments infrastructures. Merchants receiving these funds through deposit-based payment systems do not worry about the source of these funds; they transfer at par.

Visa’s growing involvement in stablecoins reflects the broader trend of financial giants experimenting with digital assets to keep pace with the fast-moving crypto world. In countries where local currencies are subject to inflation or instability, stablecoins offer an appealing alternative. As adoption continues to grow and innovation flourishes alongside popular cryptocurrencies, stablecoins are set to become a cornerstone of the digital economy, transforming the way we conduct FX transactions for years to come. Ripple announced in April that it will begin offering its own dollar-based digital currency product in the U.S. with possible expansion to Europe and Asia. As stablecoins continue to grow in market share, considering the importance of stablecoin regulation stablecoins become crucial, reflecting the increasing scrutiny and calls for tighter regulation by regulators and politicians. The potential use cases for stablecoins like PYUSD are diverse and far-reaching.

Issuers can potentially freeze accounts, block transactions, or alter the stablecoin’s supply, which reduces user autonomy and trust. It’s pegged to the U.S. dollar but backed by a basket of cryptocurrencies, primarily ethereum. Another example is sUSD, issued on the Synthetix platform, which is backed by SNX Synthetix Network tokens. With stablecoin technology, we empower businesses to grow by expanding their access to new customers.

Cedar Money was founded in 2022 and is a blockchain-based platform that simplifies cross-border payments for businesses in Africa. The fintech enables businesses to send high-volume payments to international suppliers at affordable rates, by leveraging digital currencies including stablecoins. In the last decade, we’ve seen their steep growth, reaching a market cap of $165 billion in July 20241, and representing trillions of dollars in transactions a year. They’ve taken on a multitude of traditional money functions, including payments. While there still are regulatory frameworks being developed and improved worldwide regarding digital assets, stablecoins currently represent a practical use-case for payments to and from emerging markets.

Additionally, alliances with bridges like Celer enable zero-fee transfers and enhanced liquidity, streamlining cross-chain asset movement. BNB Chain has also teamed up with payment gateways like Alchemy Pay, Oobit, Lunu, MugglePay, and NowPayments to deliver a more seamless experience for stablecoin payments. User experience is paramount in driving the adoption of stablecoins and DeFi.

In October, we processed $25M in transaction value, marking our second-best month ever in terms of payment volume. USD-denominated stablecoins account for nearly half of enterprise crypto payments made on Request Finance. Despite adverse events such as the temporary de-peg of USDC which occurred after the recent closure of SVB, the sustained popularity of stablecoins is reflected in their widespread use in enterprise crypto payments. It also allows employees and employers to easily review transaction histories, including the exact amount paid, to whom, when, and the market price at the time of payment.

By integrating stablecoins into similar platforms, individuals can further benefit from cross-border remittances, savings, and payments in a stable currency like the US dollar, without relying on traditional banks. This opens up new opportunities for economic empowerment, especially for women and rural communities who are often excluded from formal financial systems. Celo, a blockchain platform designed for mobile-first financial services, has introduced cUSD (Celo Dollar), a stablecoin pegged to the US dollar, to help individuals in Africa send and receive remittances. In many African countries, mobile money is widely used, but traditional remittance services remain expensive and slow. Celo aims to address this by offering a stable, blockchain-based solution for cross-border payments that can be accessed via smartphones. Stablecoins are also playing a crucial role in promoting financial inclusion, particularly in regions with limited access to traditional banking services.